ARCHITECT'S LAB

Professional Trading Certification

The Architect’s Lab is a structured professional trading certification program designed to develop disciplined, process-driven professional traders capable of operating under defined risk, execution, and review standards.

The program consists of a comprehensive curriculum spanning market structure, psychology, risk management, options, volatility, portfolio construction, and professional execution frameworks.

Architect’s Lab is not a short-term course or tactical workshop.

It is a full professional training environment.

Learn Trading Psychology, Frameworks, & more!

Learn to design and execute trades with institutional discipline

A structured, process-driven framework for trading financial markets with defined risk, probability-based decision-making, and repeatable execution standards. The program focuses on how trades are planned, structured, managed, and reviewed.

Gain a comprehensive, professional trading skill set

This program is designed for active traders seeking to operate with consistency and structure across market conditions. Across 13 integrated courses, participants develop competence in trading psychology, market structure, options, volatility, risk management, portfolio construction, and systematic review - applying each component within a unified professional framework.

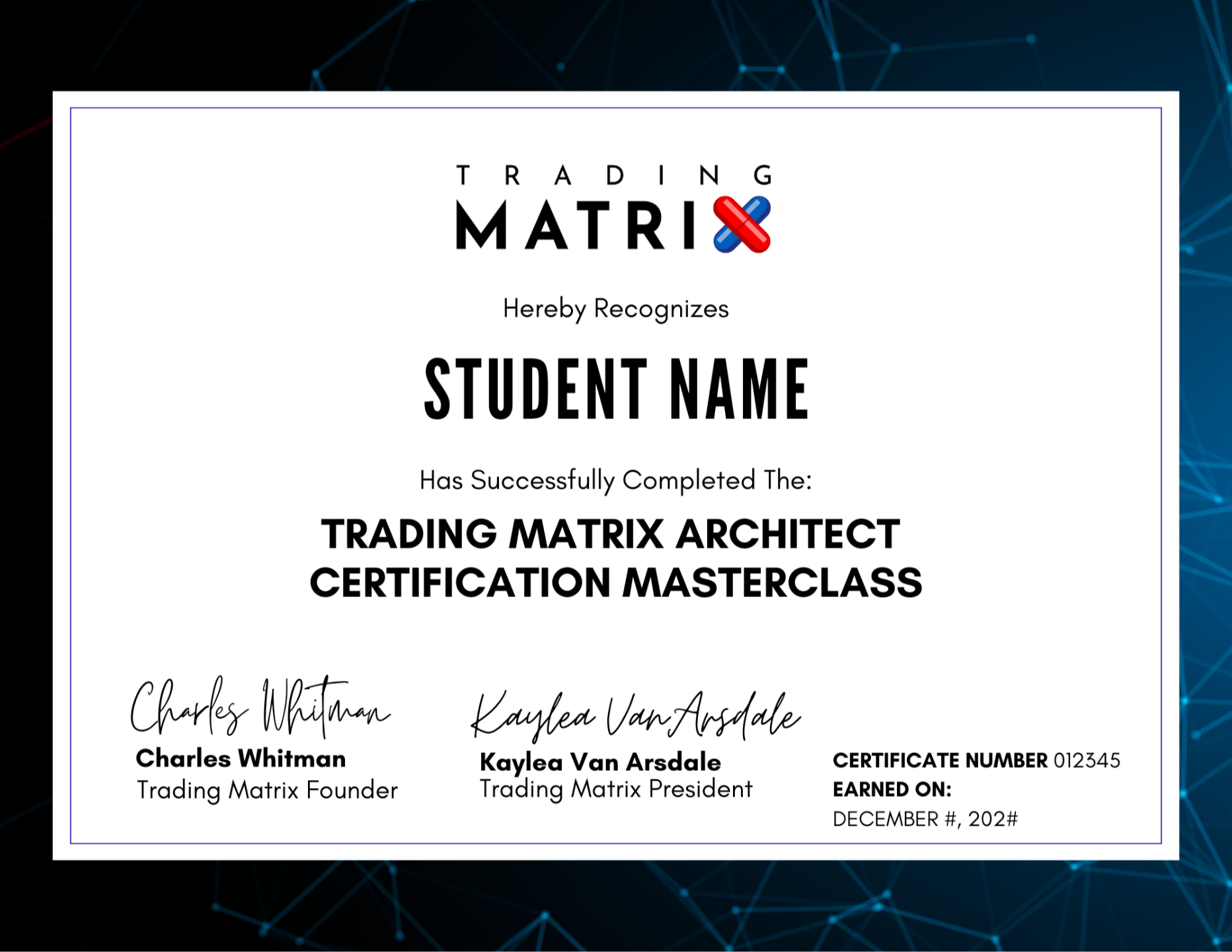

Earn a formal trading certification

Upon successful completion of the program, participants earn the Trading Matrix Architect Certification, recognizing demonstrated proficiency in process-driven trading, risk control, and execution discipline. Certified participants may become Trading Matrix Instructors, Trading Matrix Traders, or join the Operators Masterclass.

Exit the Simulation. Enter The Matrix.

Learn From the Best. Trade Like the Best!

Chuck has trained the World's TOP Traders at ...

The Architect’s Lab was developed by Chuck Whitman, a professional trader who has trained traders now working at the world’s top trading firms and financial institutions.

The program reflects the same process-driven standards, risk discipline, and execution frameworks used in professional trading environments - adapted for a structured, year-long certification format.

Over the course of 12 months, participants are trained using the same frameworks Chuck Whitman has used to develop traders operating in institutional settings. Instruction emphasizes decision structure, risk control, probability-based thinking, and disciplined execution across a wide range of market conditions.

Rather than focusing on isolated strategies, the Architect’s Lab integrates psychology, market structure, options, volatility, and portfolio construction into a unified professional trading framework grounded in real-world trading experience.

ARCHITECT PROGRAM CURRICULUM

MATRIX MINDSET MASHUP

WEEK 2 (Note: week 1 is an introductory/orientation week)

This professionally structured trading psychology course is designed to help traders achieve consistent profitability by transforming how they think, act, and operate in the markets. Focused on trader mindset, trading psychology, emotional discipline, and performance optimization, the course guides participants through identifying their true purpose as a trader, eliminating self-sabotaging behaviors, and building the identity required for long-term success. Students learn how elite traders make quantum performance leaps, apply the Have–Do–Be principle, and use proven frameworks such as the Explosive Earnings Formula, peak trading state conditioning, and psychological non-attachment to prevent overtrading and emotional decision-making. Through structured morning and nighttime success rituals, fear-management techniques, and professional mental models used by consistently profitable traders, participants develop the habits, clarity, and confidence necessary to reach impossible trading goals, sustain high performance under pressure, and step into the role of the Infinite Wealth Trader with precision and discipline.

MATRIX MINDSET MASTERCLASS

WEEKS 3-7

This masterclass is designed to help traders build a complete, repeatable trading system by mastering the core pillars of strategy, psychology, risk management, execution, and performance review. With a strong emphasis on trading plans, money management, and disciplined execution, participants learn how to structure and select strategies with confidence while aligning them to their personal trading psychology. The course walks traders through world-class daily preparation routines, intraday decision-making frameworks, and end-of-day and next-day review processes used by consistently profitable traders. Students gain clarity on entering and exiting trades with precision, setting measurable trading goals, tracking performance metrics, and conducting objective trade reviews to eliminate emotional bias.

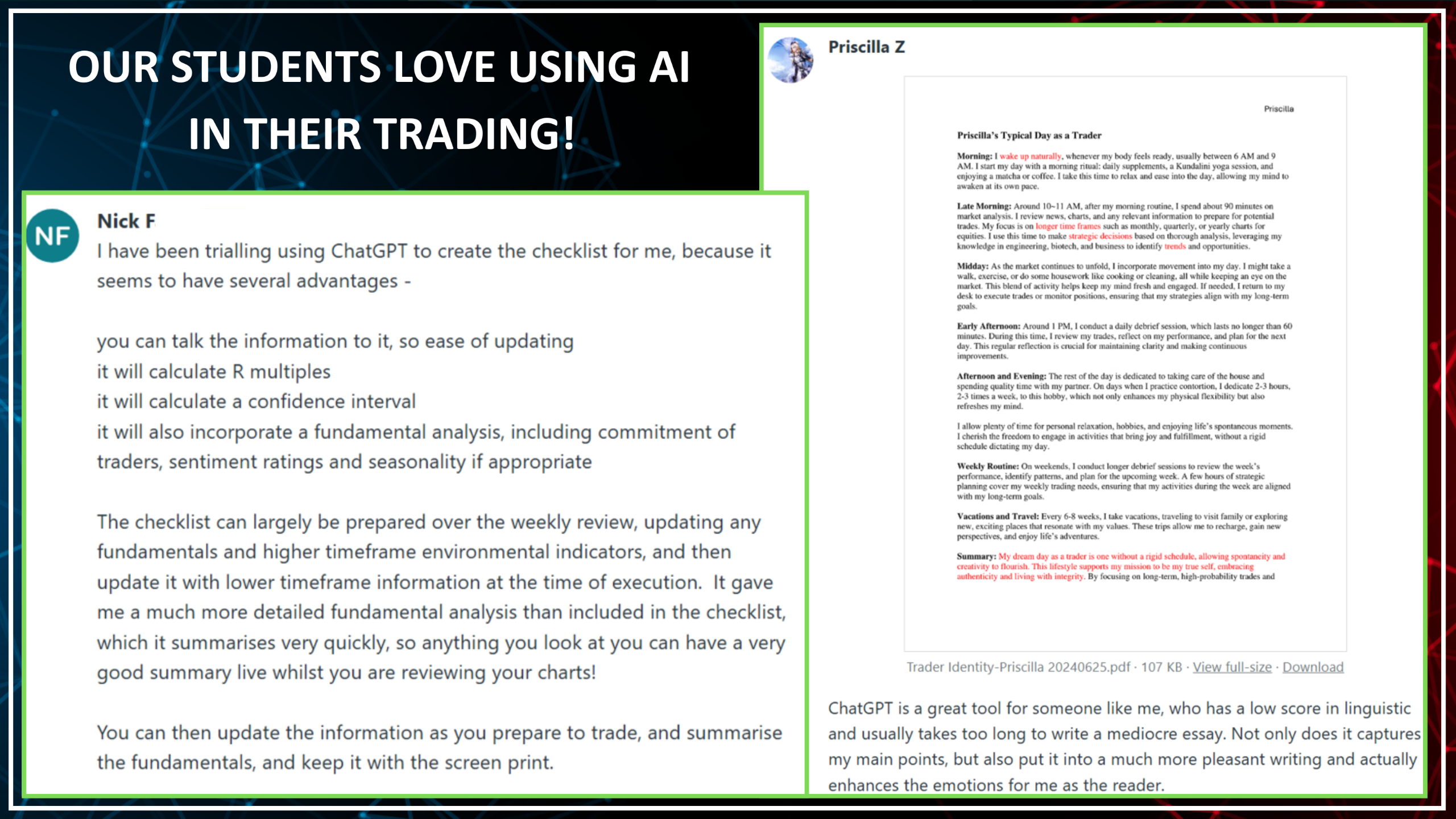

AI FOR TRADERS

WEEKS 8-10

Advanced, practical training designed to teach traders how to use GPTs as a structured decision-support system for trading, life alignment, and business execution. Students learn how GPTs actually work - including context windows, memory limits, and instruction hierarchy - so they can create reliable prompts and purpose-built GPTs for Body, Being, Balance, and Business. The program covers project planning, custom instructions, Learning Stacks for emotional processing and problem-solving, and reflective use cases such as journaling, values-based integration, and spiritual or mindset work. The training then moves into direct trading and system-building applications, showing traders how to automate daily market prep, generate watchlists and trade plans, and use GPT for trade journaling, mental game coaching, and accountability. Participants learn to build and test GPT-assisted trading systems with defined entry/exit logic, conditional rules, and money management models, create backtest-ready templates, and refine existing strategies through structured performance reviews.

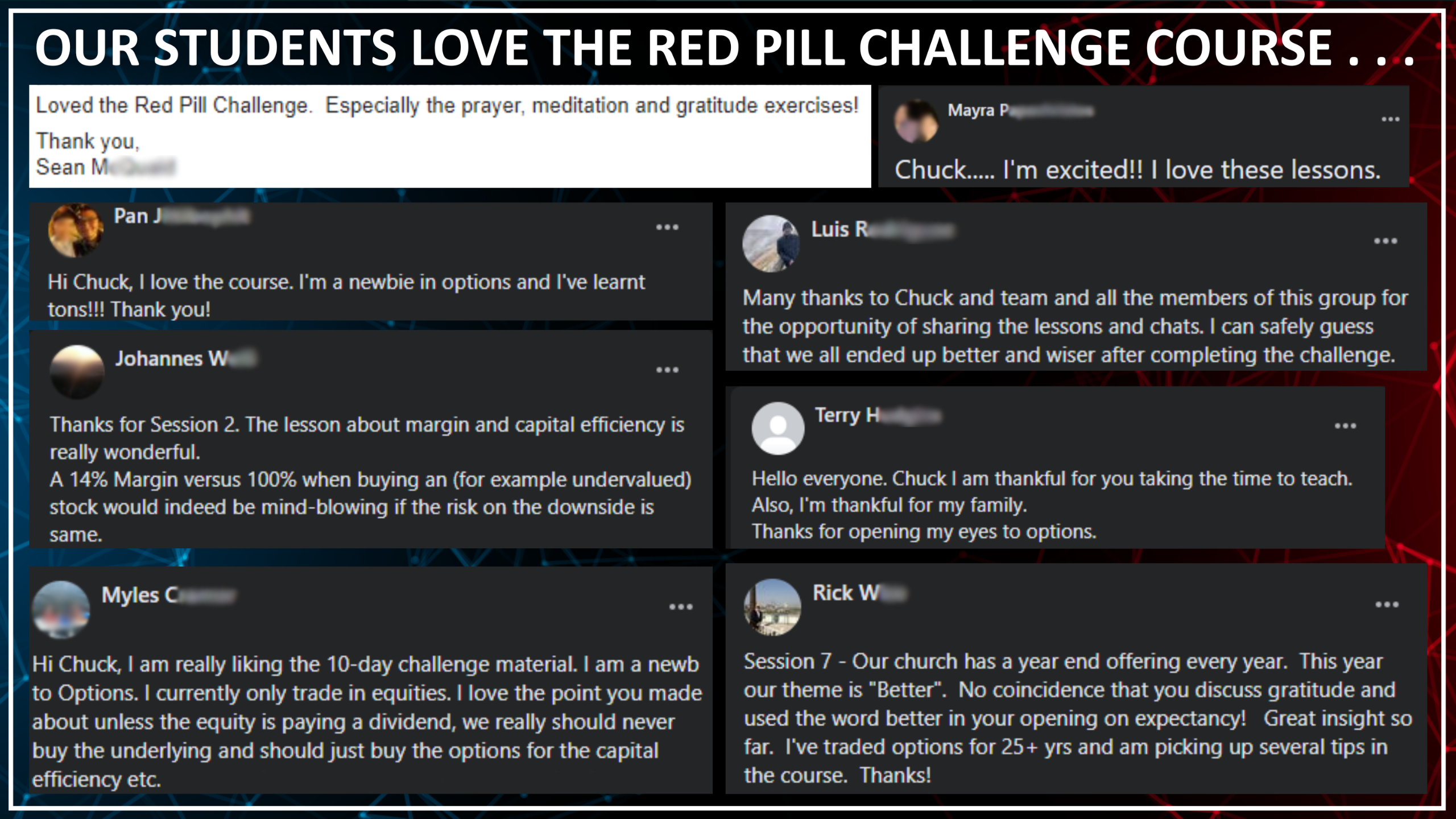

RED PILL CHALLENGE

WEEK 11

This foundational options challenge is designed to give traders a clear, professional understanding of how options work and how to use them strategically in real market conditions. It covers essential options concepts including calls and puts, intrinsic and extrinsic value, in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM) contracts, as well as the mechanics of exercise and assignment. Traders learn why to use long and short calls and puts, gaining clarity on directional bias, risk exposure, and income versus speculation strategies. The challenge also explains why to use put–call parity and long and short straddles.

MATRIX MONEY MACHINE WORKSHOP

WEEKS 12-15

This workshop is the foundational training designed to develop a trader’s volatility intelligence, execution awareness, and strategic edge before capital is put at risk. It focuses on understanding how options pricing, volatility dynamics, and market structure drive outcomes - not just trade direction. Traders receive in-depth education on the four core Greeks, advanced volatility interpretation, and high-probability techniques for anticipating future volatility expansion and contraction. Rather than reacting to price alone, participants learn to structure option trades that outperform the underlying asset by aligning strategy selection with volatility conditions. The workshop also introduces professional execution principles, including liquidity optimization and slippage reduction, along with advanced frameworks such as WAM Relative Strength, the BB GUN Volatility Contraction System, and the WAM Dividend Accelerator Model for identifying undervalued opportunities. This phase establishes the analytical and structural foundation required for disciplined, repeatable options trading.

CODEBREAKER WORKSHOP

WEEKS 16-20

An advanced price action and market structure training designed to teach traders how to decode market dynamics, capital flow, and behavioral intent behind price movement. Rather than relying on indicators, traders learn to read the market as an auction process, understanding underlying trends, market bias, volatility conditions, and unfolding activity in real time. The workshop delivers a deep foundation in candlestick construction, supply–demand dynamics, and price action behavior, including thrust bars, engulfing patterns, and the critical transitions between consolidation, breakout, continuation, and reversal environments. Volume and volatility are treated as leading indicators, equipping traders to identify runaway volume, trend sustainability, momentum acceleration, and exhaustion using tools such as the 5 Bar Runaway Count and exhaust bar analysis. Building on this structural understanding, Codebreaker trains traders to recognize and trade high-probability chart patterns and runaway market environments with precision. Students learn to identify major reversal and continuation patterns, simplify pattern recognition through the two core structures that encompass all others, and frame entries, exits, and risk management directly from price action and volume. Advanced instruction integrates multi-timeframe analysis, Market Profile concepts, and the Initial Balance Period (IBP) to align intraday execution with higher-timeframe structure. Through market analysis, case studies, and backtesting, traders develop a repeatable, professional execution framework capable of producing large asymmetric opportunities while maintaining discipline, clarity, and consistency across changing market conditions.

MATRIX MONEY MACHINE MASTERCLASS

WEEKS 21-24

This masterclass is the applied execution phase of the Matrix Money Machine Framework, designed for traders ready to translate strategy knowledge into consistent, professional trade execution. Building directly on the Matrix Money Machine workshop, this masterclass emphasizes hands-on practice, structured decision-making, and real-time trade management within a simulated environment. Students actively execute the WAM Dividend Accelerator, compare the use of covered calls versus call spreads, and deploy bull and bear spreads to align positions with market bias and volatility expectations. Traders work through live and simulated BB GUN trades over the duration of the program, learning how to manage risk, adjust positions, hedge exposure with options, and execute strategies precisely on broker platforms. Through structured case studies, backtesting exercises, and performance reviews, traders refine their ability to filter BB GUN signals into a short, actionable trade list and follow a defined trading plan with clarity and confidence.

SLINGSHOT TRADING SYSTEM

WEEK 25

A precision-based options trading framework designed to capture explosive upside from high-probability market reversions while maintaining clearly defined risk. This system teaches traders not just how to trade, but what to trade, by identifying the strongest markets and instruments and waiting patiently for pullbacks into statistically favorable reversion zones. Using long options structures, traders cap downside risk by design while positioning for asymmetric reward, eliminating the need for tight stop-outs or constant screen monitoring. Slingshot is built on market environment filtering and disciplined portfolio control. Traders learn how to activate the system only when market structure supports the edge, and just as importantly, when to stand aside. The training emphasizes professional-level entry, exit, and risk management, alongside a simplified portfolio framework that prevents overtrading and overexposure. Traders develop a calm, rules-based approach that prioritizes precision, patience, and repeatable performance over reactive decision-making by learning how to allocate, rotate, and protect capital across opportunities.

MATRIX MONEY MACHINE RELOADED

WEEKS 26-33

This is the most comprehensive level of the Matrix Money Machine framework, designed for traders committed to operating with system integrity, portfolio awareness, and professional structure. This course integrates foundational options mechanics with advanced volatility modeling, BB GUN execution, and portfolio-level risk management into a unified trading methodology. Traders deepen mastery of options structures, spreads, straddles, synthetics, conversions, and reversals, while developing the ability to evaluate stocks and futures using both technical and fundamental analysis. The program expands into volatility forecasting, Greeks-based positioning, timeframe rolls, and portfolio-level management to ensure consistency across varying market regimes. Anchored by the 10 Irrefutable Laws of Trading Success, Reloaded equips traders to think beyond individual trades and operate as disciplined market professionals capable of sustaining performance over time.

VERTICALITY CHALLENGE

WEEK 34

A focused, high-impact options trading program designed to teach traders how to use vertical spreads to dramatically increase efficiency, precision, and profitability without increasing risk or screen time. This challenge shows traders how to achieve the same market exposure using up to 85% less capital, reduce margin requirements, and structure trades with clearly defined risk and reward. Students learn how to create positions that can remain profitable even when price direction is imperfect, while significantly reducing downside exposure, execution slippage, and emotional overthinking by leveraging vertical spreads. The training emphasizes aligning direction and volatility in the trader’s favor, customizing strategies to individual psychology, and executing with professional-level discipline rather than guesswork. The challenge combines foundational trading principles with hands-on spread execution. Traders progress through long and short call spreads, long and short put spreads, and bull and bear spread structures, each reinforced with targeted assessments to ensure mastery. Students are prepared to deploy leveraged, capital-efficient options strategies that produce larger asymmetric winners, limit losses by design, and support decisive, confident trading, without spending all day glued to a screen.

PRINCIPLES OF VERTICALITY

WEEKS 35-39

An advanced options strategy training designed to help traders master vertical spread selection and optimization across changing volatility environments. This workshop focuses on identifying volatility transition flow points and selecting the appropriate vertical spread structures to align with market conditions, directional bias, and risk objectives. Traders learn how to implement the Trading Matrix of Vertical Spreads to systematically match strategy selection with specific trading goals, removing guesswork and increasing consistency. Emphasis is placed on structuring trades that balance capital efficiency, defined risk, and asymmetric reward, while adapting to shifts in volatility and market behavior. Building on this framework, the workshop delivers advanced instruction on integrating vertical spreads within the BB GUN System to drive outsized performance. Traders learn how to deploy multi-strike option structures, adjust strike selection to reflect market expectations, and fine-tune risk–reward profiles as trades evolve. Students gain the ability to customize trades with precision and confidence by understanding how strike placement influences probability, payoff, and volatility exposure. This workshop equips traders with a professional, repeatable methodology for executing vertical spreads as a strategic tool designed to perform consistently across market regimes while maintaining disciplined risk control.

THE VOLATILITY PLAYBOOK

WEEKS 40-43

Advanced options strategy program designed to expand upon the Matrix Money Machine framework by introducing higher-order option structures optimized for specific volatility environments. Built on the Volatility Expectation Model, this course teaches traders how to select and deploy the right strategy based on forward volatility scenarios rather than price direction alone. The focus is on operating in the Matrix, using scenario planning and volatility intelligence to pursue greater outperformance potential while maintaining defined risk and structural discipline. Students learn a full suite of single-expiration, multi-strike option strategies, including ratio spreads, back spreads, butterflies, condors, iron butterflies, iron condors, and Christmas trees, and how to apply the Options Metamorphosis concept to dynamically adapt positions as market conditions evolve. The course teaches how to use the BB Bazooka System for outsized options performance and the WAM Market Neutral Strategy to complement BB Gun setups and smooth the overall equity curve. The Volatility Playbook equips traders with a sophisticated, repeatable framework for exploiting volatility mispricing and executing complex option strategies with confidence and precision by integrating volatility forecasting, strategy selection, and professional scenario planning.

WAM DIVIDEND ACCELERATOR MASTERCLASS

WEEKS 44-48

An execution-focused options income program designed to help traders generate consistent cash flow while maintaining disciplined risk control. This masterclass centers on the practical application of the WAM Dividend Accelerator Model, teaching traders how to identify undervalued stocks and systematically create income while waiting for longer-term price activation. Students practice the full mechanics of the strategy within a simulated trading environment, allowing them to execute the trading plan, manage positions over time, and build confidence without unnecessary capital risk. The training explores the strategic use of call spreads versus traditional covered calls, including the advantages, trade-offs, and optimal conditions for each approach. Traders work through simulated trades, real-world case studies, and backtesting exercises to understand how the strategy performs across market conditions. The masterclass also teaches advanced techniques for extracting cash from trades to lock in profits and increase overall returns, reinforcing a professional, rules-based approach to income generation.

Community & Program Benefits

Elite Trader Tribe!

Find your people. Accelerate your edge.

Trading is not meant to be a solo pursuit. Inside the Trader Tribe, you’re surrounded by disciplined, growth-oriented traders who take strategy, execution, and accountability seriously. This is a collaborative environment where ideas are pressure-tested, progress is supported, and consistency is built together. The collective intelligence of the group becomes a competitive advantage.

LIVE Trading Chatroom

Real-time markets. Real-time feedback.

Access an active, high-signal chatroom where traders and coaches engage throughout the trading day. Chat with your peers, ask questions, share setups, validate trade logic, and gain immediate clarity when markets are moving.

Market News & Wins

Stay informed. Stay focused. Stay motivated.

We curate relevant market news, structural insights, and real-time wins from across the community to keep your perspective sharp.

Extensive Course Access

Master the mindset, strategy, and execution.

Gain full access to a comprehensive library of professional trading education, from foundational options and mindset training to advanced volatility systems and execution frameworks. Learn at a structured pace while remaining supported by live discussion, community feedback, and ongoing application.

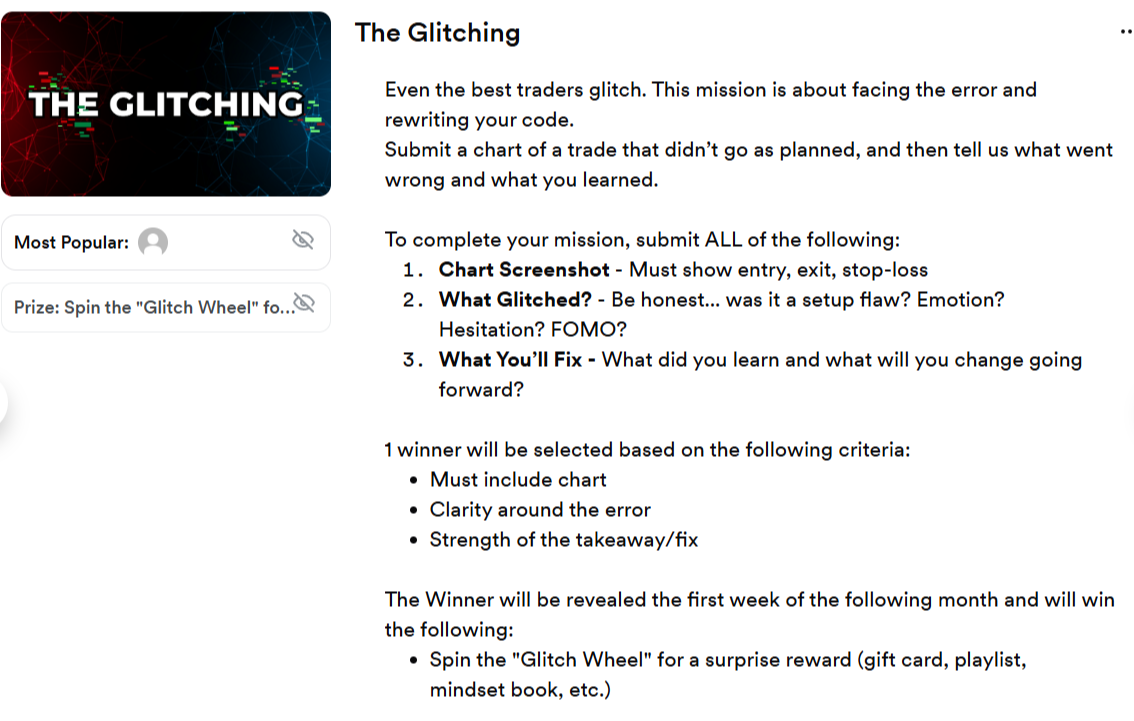

Monthly Mission/Contest

Structured challenges. Real rewards.

Each month, members participate in a focused mission designed to strengthen discipline, consistency, and execution. These challenges are built to reinforce professional trading habits and life balance with leaderboards and prizes that reward follow-through, process mastery, and performance.

Question & Answer Zone

Direct access. No dead ends.

Submit your toughest trading questions inside the Q&A Hub and receive clear, direct answers from experienced coaches and veteran traders. Whether it’s strategy selection, execution logic, or mindset blocks, support is always accessible - no spinning, no guessing, no isolation.

Architect Lab is for you if…

- You know there's more to trading, and to life, than chasing setups and hoping to win.

- You're ready to wake up to the Matrix of markets and start designing your reality.

- You want ready-to-use strategies to build wealth now, and the power to evolve them.

- You want to think, not just act, like a great trader.

- You're drawn to mastery, mission, and momentum ... not just money.

Architect Lab is NOT for you if…

- You're looking for a signal service, a shortcut, or someone to trade for you.

- You want to stay plugged into the same old loop of no accountability, and no real ownership.

- You're allergic to structure, challenge, or feedback.

- You'd rather chase dopamine than build discipline.

💥 Ready to Earn Your Certificate?

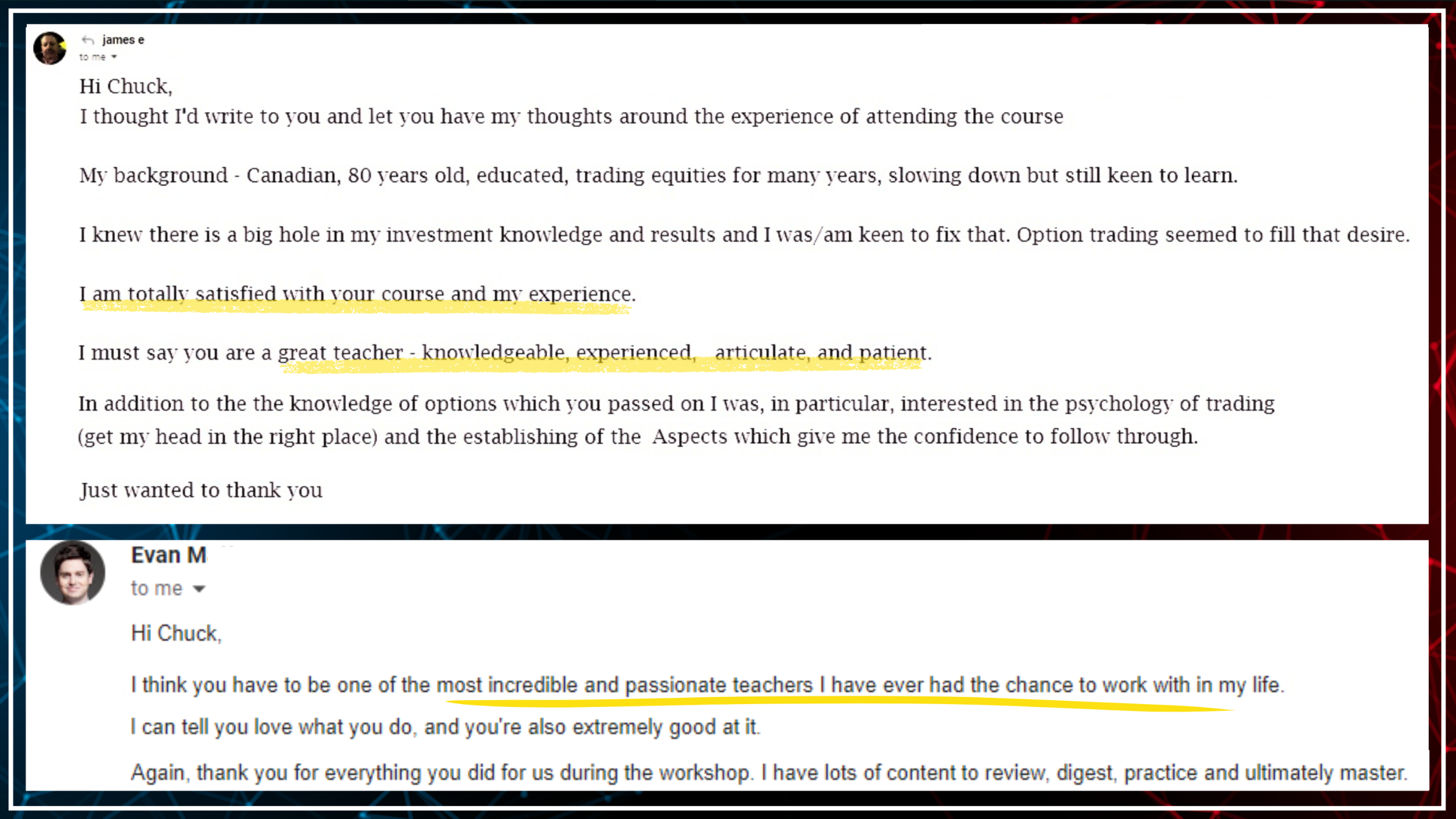

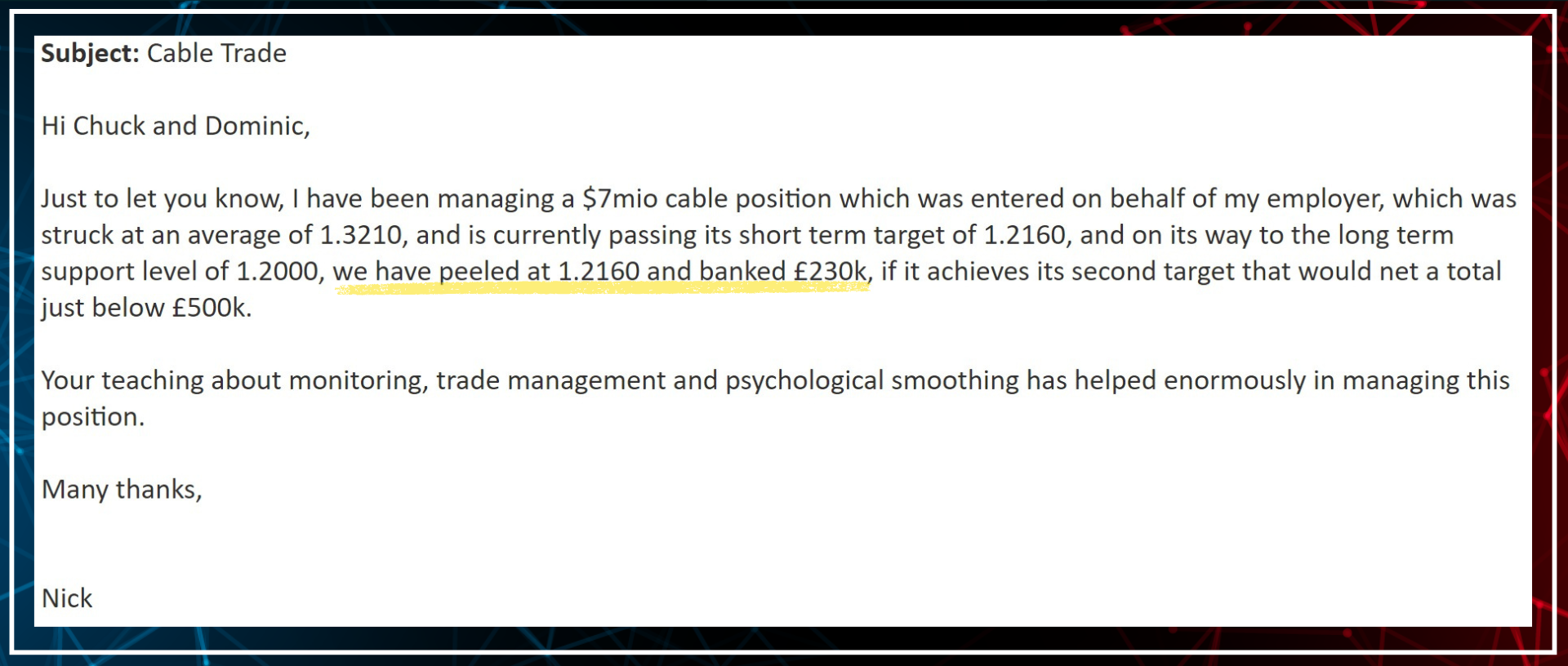

Real Traders. Real Execution. Real Results.

Hear directly from traders applying the systems, frameworks, and discipline found inside the program.